|

| https://staticaws.narrpr.com/Reports/bac96dac/770a-46fd-a41f/87b344553b6f/Market-Activity-Report_Westerly-RI-02891_2019-07-08-18-33-05.pdf |

Serving East Lyme, Waterford, Salem, Uncasville, Norwich, New London, Groton, Gales Ferry, Ledyard, Preston, Mystic, Stonington, Stonington Borough, Pawcatuck, North Stonington, Westerly, Watch Hill, and Charlestown. Call or Text Bridget Morrissey at (860) 857-5165.

Showing posts with label best real estate agents in Westerly. Show all posts

Showing posts with label best real estate agents in Westerly. Show all posts

Wednesday, July 17, 2019

Westerly Real Estate Market Report for July 2019 from Westerly Realtor Bridget Morrissey

Tuesday, June 18, 2019

Westerly Real Estate Market Activity Summary for the month of May 2019

The Westerly Real Estate Market Activity Summary for the month of May 2019 is brought to you by Westerly Realtor Bridget Morrissey. It shows that there were 31 homes sold and 33 are pending. There were 100 active homes for sale in Westerly in May. Eleven units were sold in 0-30 days, six in 31-60 days, eight in 61-90 days, four in 91-120 days, none in 121-180 days, one in 181-365 days and one took over a year to sell. For the entire Westerly Real Estate Market Report from Westerly Real Estate Agent Bridget Morrissey please click HERE.

Bridget Morrissey is an award-winning Realtor serving

southeastern Connecticut and southern Rhode Island.

Always on the move, and so are her clients!

Monday, February 18, 2019

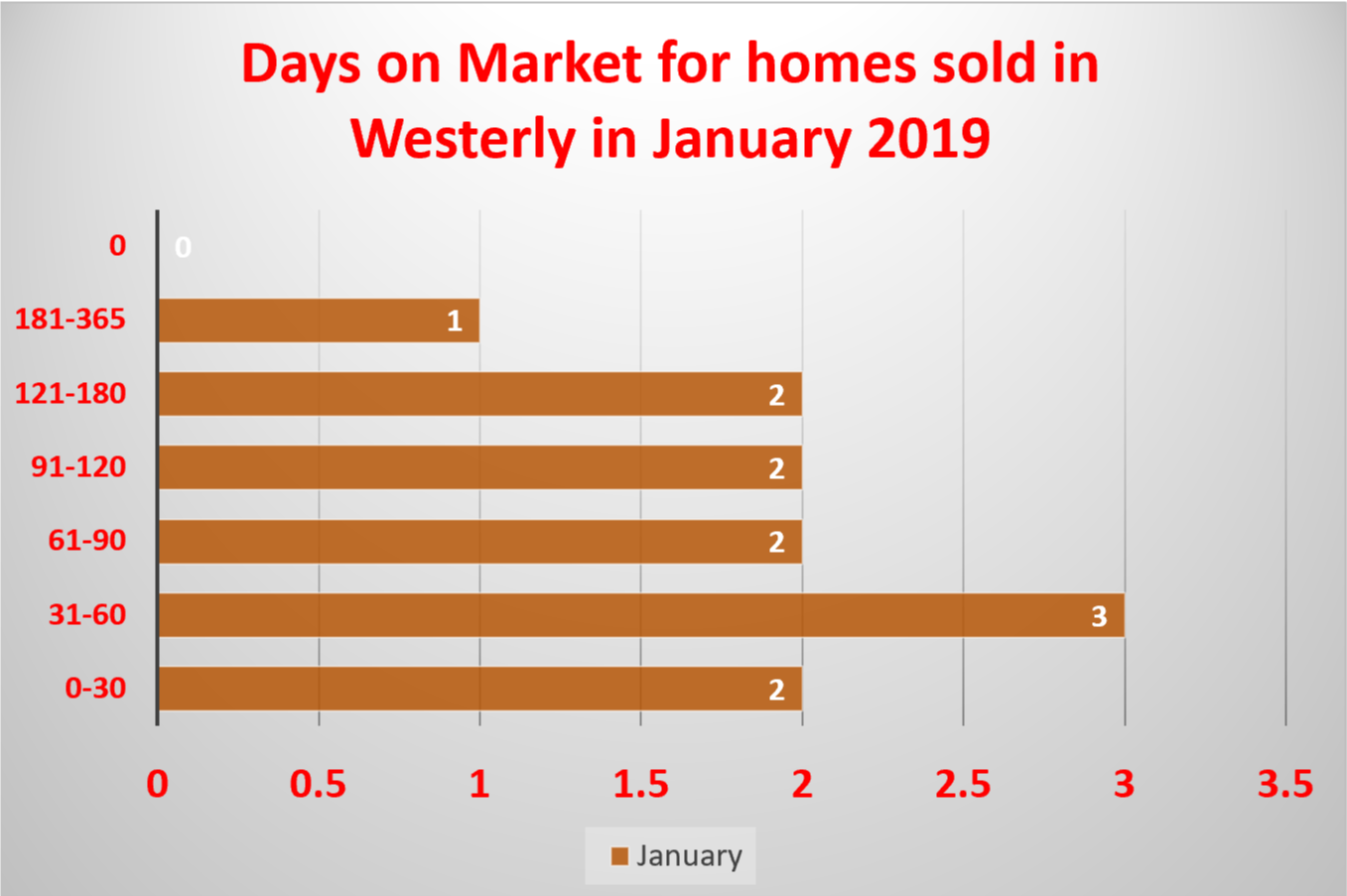

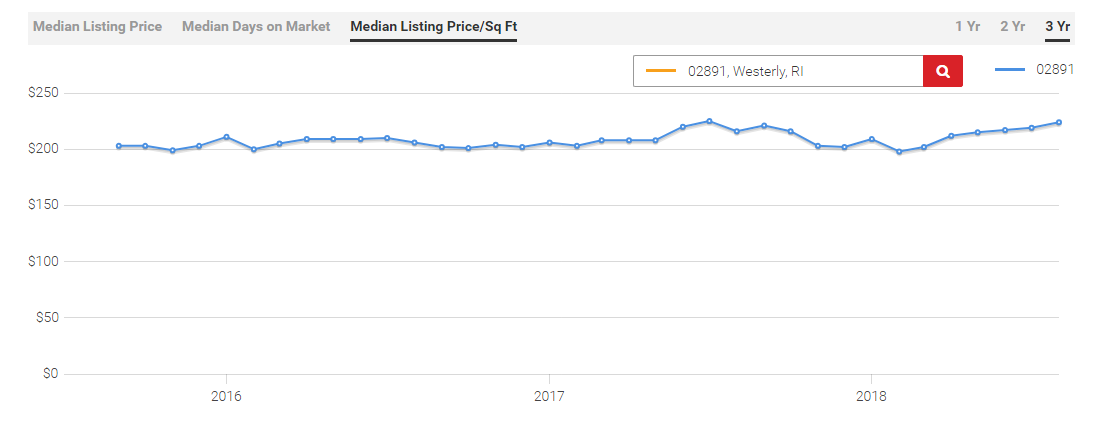

Westerly Real Estate Market Report February 2019 by Westerly Realtor Bridget Morrissey

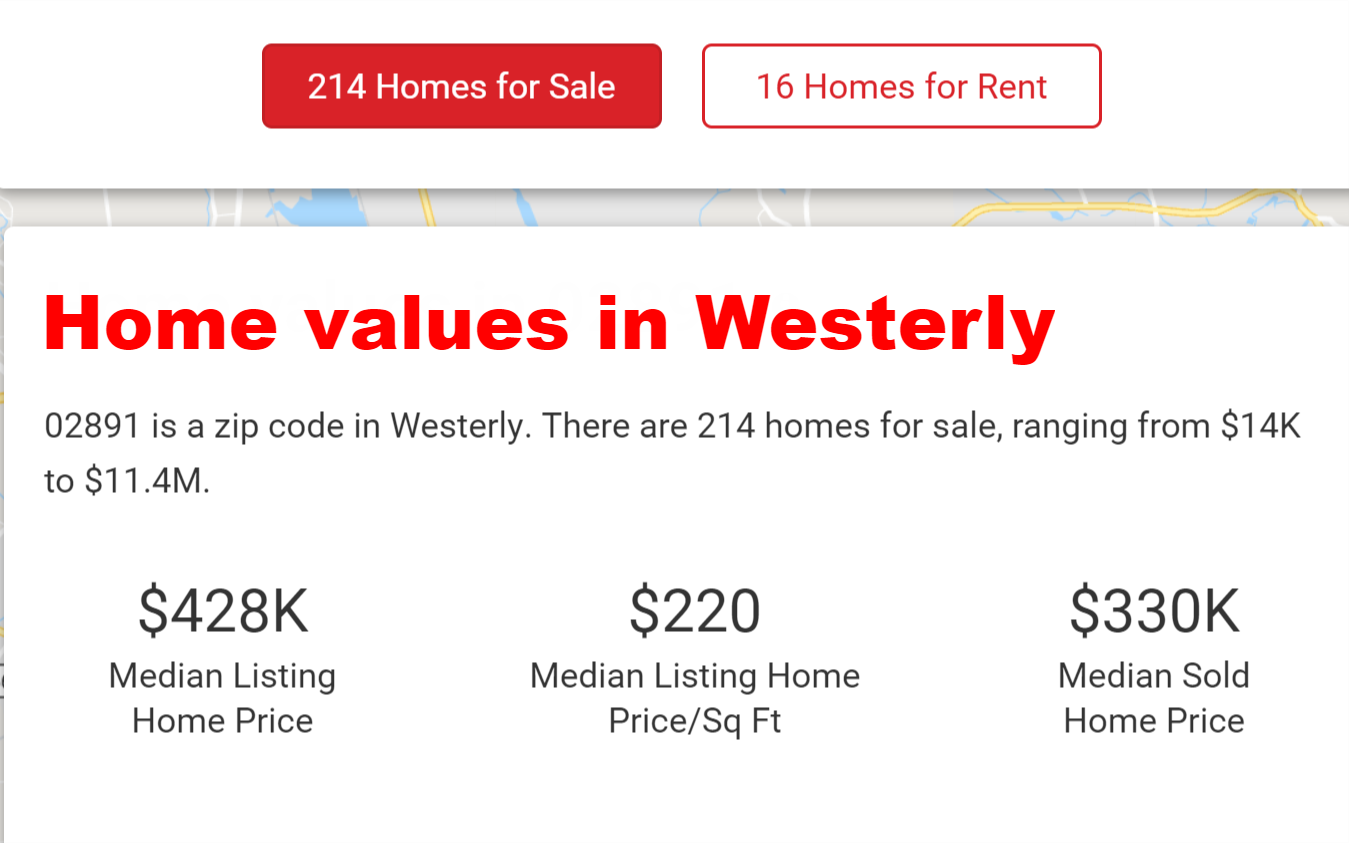

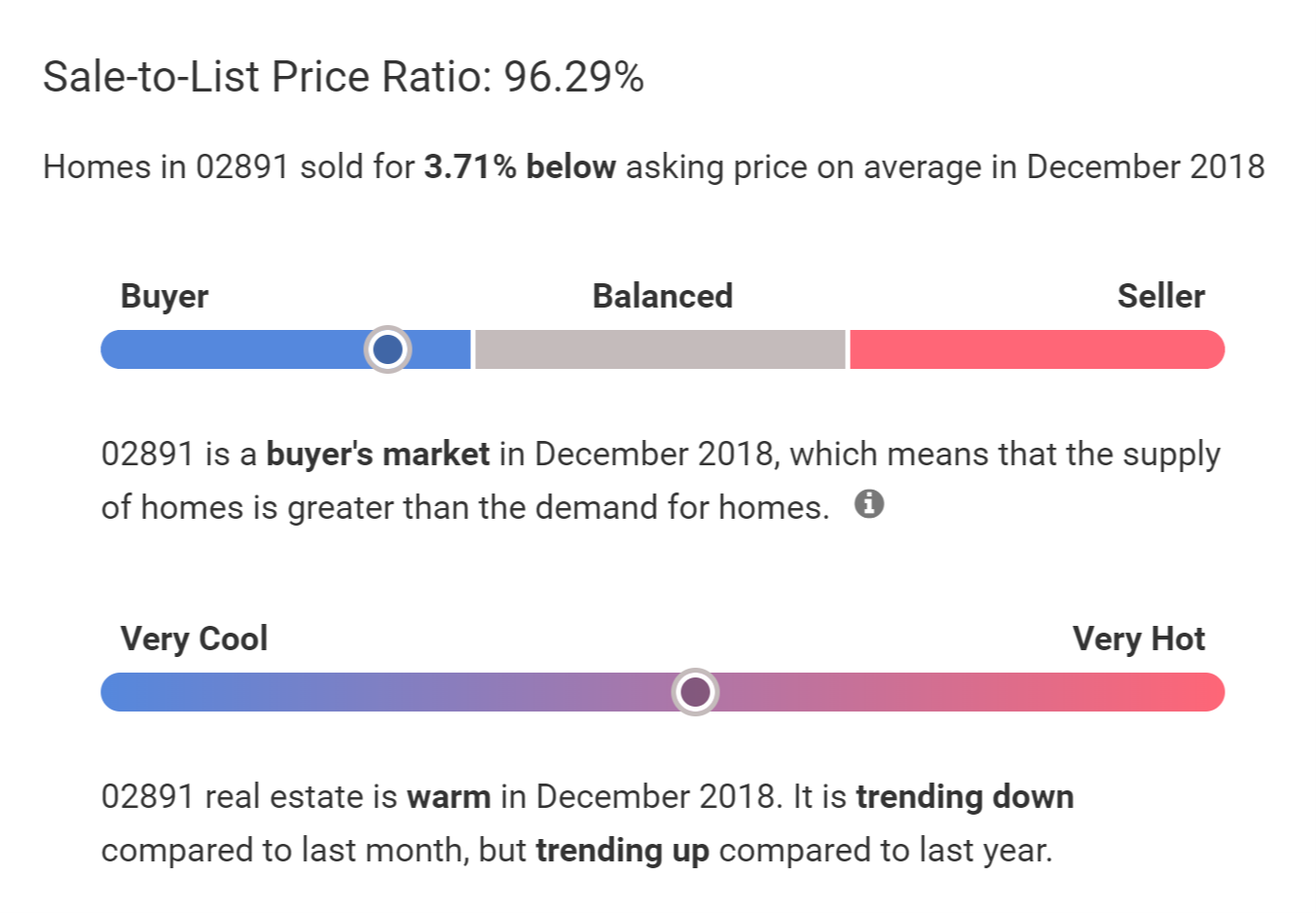

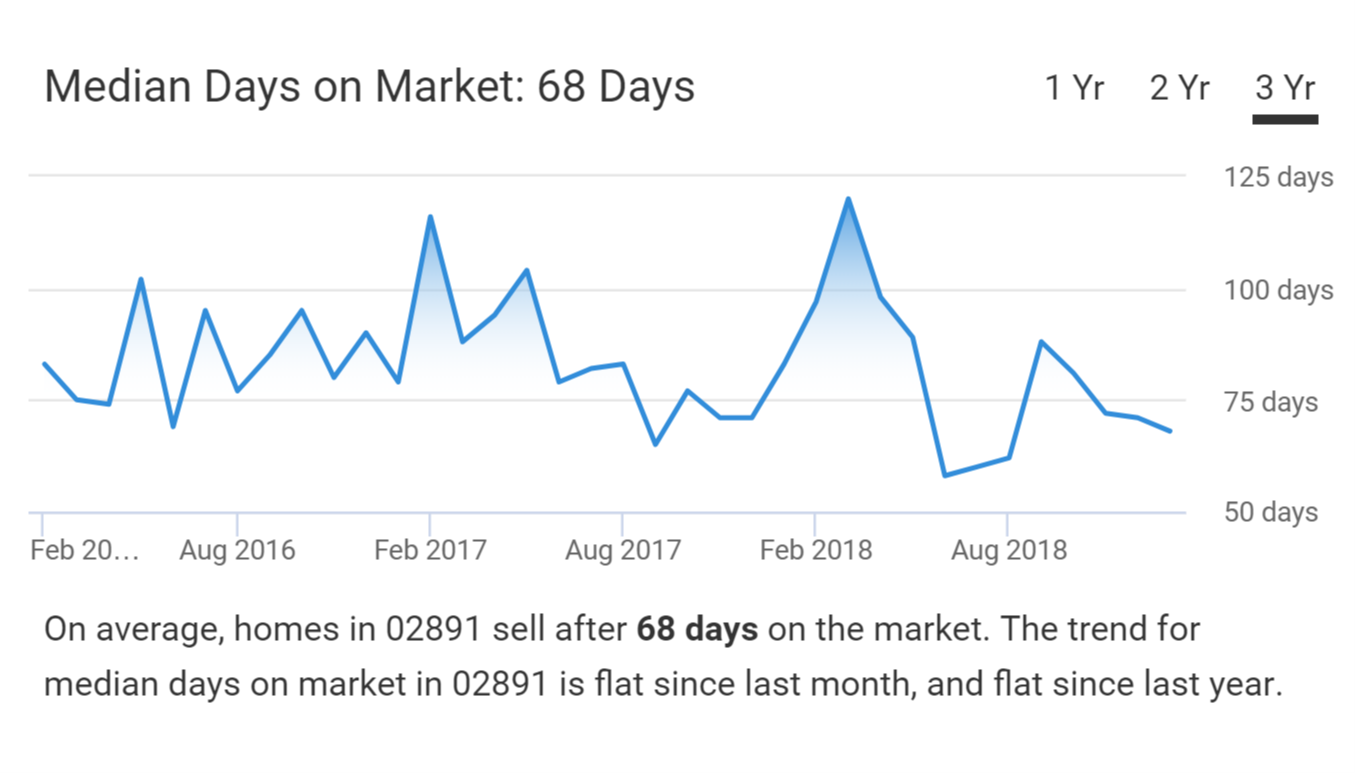

The Westerly Real Estate Market Report is brought to you by Westerly Realtor Bridget Morrissey.

Days on Market

Median List Price

Median Price / Sq Ft

According to Wikipedia, Westerly becomes a large tourist attraction during the summer months during which the population nearly doubles. From east to west, well-known beaches include Weekapaug Beach, Westerly Town Beach, Misquamicut State Beach, East Beach and Watch Hill Beach. Weekapaug is a Native American word meaning "end of pond". Niantics, Pequots, and Narrangansetts lived in this area before early settlers arrived. Misquamicut Beach is a three-mile length of beach that extends westward from Weekapaug to Watch Hill and separates Winnapaug Pond from the Atlantic Ocean.

Watch Hill is an affluent coastal village in the town of Westerly, Rhode Island. It sits at the most-southwestern point in all of Rhode Island, excluding Block Island. Watch Hill came to prominence in the late 19th and early 20th century as an exclusive summer resort, with wealthy families building sprawling Victorian-style "cottages" along the peninsula. Watch Hill is characterized by the New York Times as a community "with a strong sense of privacy and of discreetly used wealth", in contrast with "the overpowering castles of the very rich" in nearby Newport. Today, Watch Hill is best known as the backdrop for the Ocean House, the only Forbes Five-Star and AAA Five Diamond Hotel in Rhode Island.

Thursday, November 1, 2018

The FHA Basic Home Mortgage Loan 203(b)

While you’re dreaming about your Starter Home, don’t forget that you’re going to need a Starter Mortgage to pay for it. Stonington Realtor Bridget Morrissey knows that the mortgage programs offered through the Department of Housing and Urban Development’s Federal Housing Authority can be easy ways for borrowers with limited or lightly bruised credit to enter the housing market with confidence.

Of course, like with any mortgage, FHA loans aren’t for everybody. But they are really good for many people. Let’s get to know the loan most people are talking about when they say they need an “FHA loan,” the FHA Basic Home Mortgage Loan 203(b) (what a mouthful!).

Who Is This Loan For?

Before you waste your time by reading this whole blog just to learn that you’re not a good candidate for this loan, let’s get it all out upfront, shall we? FHA mortgages are good for a wide range of people, especially those with credit scores in the mid- to upper 600s with minimal downpayments.

FHA is forgiving of some sins, including unpaid medical bills, but is less tolerant of monthly payments for things like revolving loans and secured loans (know as your “debt-to-income ratio”). Where Fannie Mae’s conventional loans may let you have upward of about 45 percent of your income going to monthly debts and housing, FHA mortgages are much more selective. Your housing debt can’t exceed 31 percent as of the writing of this blog; your overall debt has to be below 43 percent at this moment.

Looking at that in a more concrete way, it breaks down like this if you make $50,000 annually:

– Your monthly income: $4,166.67

– FHA housing debt allowed: $1,291.67

– FHA total debt allowed (includes housing) : $1,791.67

– Conventional debt allowance: $1,875

It might not seem like a big difference overall, but the FHA restricts your mortgage to about a third of your income, even though in some markets that’s a difficult, if not impossible, house to find. Your conventional loan doesn’t discriminate, so if you have no credit card debt, you might be able to buy more house.

But that’s not to say that the FHA loan is a bad mortgage. It’s a really decent one, it just has a lot of rules designed to ensure you succeed at homeownership.

The FHA Downpayment Conundrum

FHA mortgages maintain one of the lowest downpayment requirements of any mainstream mortgage offering. At just 3.5 percent, this financing type makes it easy to get into a home. That $200,000 house you’ve got your eye on? You just need $7k for a downpayment (closing costs are separate)! That’s $3k less than the conventional loan can offer.

However, there’s a pretty big catch with that low downpayment. The mortgage insurance that makes it possible for you to put down such a small amount of money is going to stick with you for the life of the loan. That’s the case, in fact, unless you’ve scraped together at least 10 percent of the sales price for a downpayment.

Theoretically, you could refinance your low downpayment FHA loan when you’ve paid down about 20 percent of the total value to shake the mortgage insurance, but there are no guarantees that you’ll end up in a better place. Rising interest rates, additional costs to close a new loan and even a new appraisal can eat into those cost-savings.

Some lenders offer a streamline refinance, which can save you a bundle when you’re ready to refinance the note you already have. Check with yours to see if the mortgage you’re signing will be eligible. You have some options, let’s make sure you’re taking advantage of them.

Oh, That Thing About Student Loans…

FHA is picky about your debt, that may have been mentioned. One thing that it is almost cruelly strict on is student loan debt. Unlike Fannie Mae, which only figures your actual payment into your debt-to-income ratio, FHA uses a formula that often ends up in a rejection for otherwise really well-qualified borrowers.

As of the writing of this article, FHA figures your monthly payment as one percent of your debt. Say, for example, you have $68,000 in student loan debt because you triple majored in everything, but you happen to be working in a field that won’t support a payment anywhere near what that debt requires to be repaid. Your federal student loan is enrolled in an Income Based Repayment program, with a payment of under $20 a month.

A conventional loan would verify that $20 and that would be all that would go into your DTI from your student loans. FHA, on the other hand, would add $680 to their calculation. Which, considering you’re on an IBR, will almost certainly make it impossible for you to qualify for anything.

TL;DR: FHA Ups and Downs

FHA has some nice features:

– Great for people with lower credit scores or small credit blemishes

– Allows for a smaller downpayment vs. other mortgages

– As a federally regulated loan, closing costs are often lower

But it also holds many buyers back with:

– Low DTI allowances

– High student loan payment calculations

– Lifetime mortgage insurance

If your overall debt is low, you don’t have a student loan to deal with (or you have a very small one) and you’re planning on selling in five or seven years, FHA loans can absolutely get you into the real estate market faster with less money out of pocket. The extra time spent putting monthly payments toward equity rather than rent can help you become more financially secure earlier.

I Want the FHA! Who Do I Call?

An FHA mortgage can be a great solution, but you need a good lender to help you get through all the paperwork that’s involved in applying for this loan. Sure, you can ask your friends who to talk to, but wouldn’t you rather hear from other professionals in the field? Your HomeKeepr community is full of people who work with bankers every day. — your Realtor will be happy to recommend your new lender, just log in and ask for the details!

Monday, October 29, 2018

Seven must know facts for smoke detectors

Every morning, it’s the same thing. You get out of bed, take a shower, burn the toast and then curse the smoke detector. Although its singing the song of its people can be incredibly loud and awful to hear, the truth is that smoke detectors save lives. So, while your smoke detector may sing way off tune, it’s trying very hard to protect you and your family from smoke- and fire-related hazards, like your morning toast.

It’s time to check your smoke detector batteries yet again — and to learn more about those white pucks that hang out on the ceiling.

Meet Your Friendly Neighborhood Smoke Detector

Every single day, your smoke alarms hang around next to the ceiling, just waiting for something to go wrong. They don’t ask for much, which is why most people tend to forget they even exist. But the job they do is vital to the safety and security of not only you and your family, but the families that neighbor you.

You’ve heard it a hundred times: check your smoke detector batteries. Check those batteries! Hey, by the way, have you checked your smoke alarm batteries? But for most people, that’s as intimate as they ever get with these clever devices. Here are some things to know about smoke detectors:

1. Working smoke alarms give you additional escape time in the case of an actual fire.Thirty-eight percent of home fire deaths from 2009 to 2013 were do to a lack of functioning smoke alarms. In the homes that had smoke alarms that failed, 46 percent had missing or disconnected batteries.

2. Best places to install smoke alarms are in each bedroom, in halls outside of bedrooms and in every major living area. Why so many? Closed doors can slow the spread of smoke and living areas on upper or lower floors may have a significant blaze going before smoke is noticeable.

3. Interconnected smoke alarms are considered the safest option currently on the market. These alarms are connected to each other and often directly powered through your home’s electrical system, with a battery backup. When one detects smoke, they all go off. It can be annoying if you tend to burn the toast, but when it’s a real fire, all that noise will be a life saver.

4. Smoke detectors work in one of two different ways. One type, called an ionization detector because it uses electrically charged particles to detect smoke in the air, is faster to respond to flaming fires with small smoke particles. The other, known as a photoelectric detector, uses beams of light to check for smoke particles in the air. These are better for smouldering fires. Both will get the job done, though!

5. Most people don’t realize that smoke detectors need maintenance, too! You should check the battery monthly and use the bristle attachment on your vacuum to clean any debris off of your detector twice a year. You’ll also want to change the battery twice a year. Many people do this when they change their clocks for Daylight Savings Time.

6. Smart Smoke Detectors can save you money on insurance. It’s true! If your smoke detectors are connected via WiFi, they can call for help or send you a message about their status. Many insurance companies love these features, as they reduce the amount of damage insured homes suffer in case of a fire. Break out the cool new tech and reap the savings!

7. There are other, similar detectors on the market. While you’re shopping for smoke detectors, you may come across heat or carbon monoxide detectors. These units look very similar, but they function very differently. Heat detectors literally detect high heat, so aren’t very fast to respond in a residential setting. They’re best used in small, confined spaces.

Carbon monoxide detectors, however, are very suitable for home use. They measure the amount of carbon monoxide, a poisonous gas created by combustion, in the air. If dangerous amounts are detected, you’ll know and be able to make your home safe again. Most homes use these in conjunction with smoke detectors.

Where There’s Smoke, Well… You Know

No one wants to deal with a house fire, but if your morning bacon cookery gets out of hand, it’s good to have an early warning system. If your house doesn’t have adequate smoke detectors, it’s time to reach out to the HomeKeepr community for the very best electrician they can recommend. When other companies put their reputations on the line to connect you with the right home pro, you know they’ve gotta be good.

Already using HomeKeepr?

Sign In

Monday, January 29, 2018

Westerly Real Estate Market Report

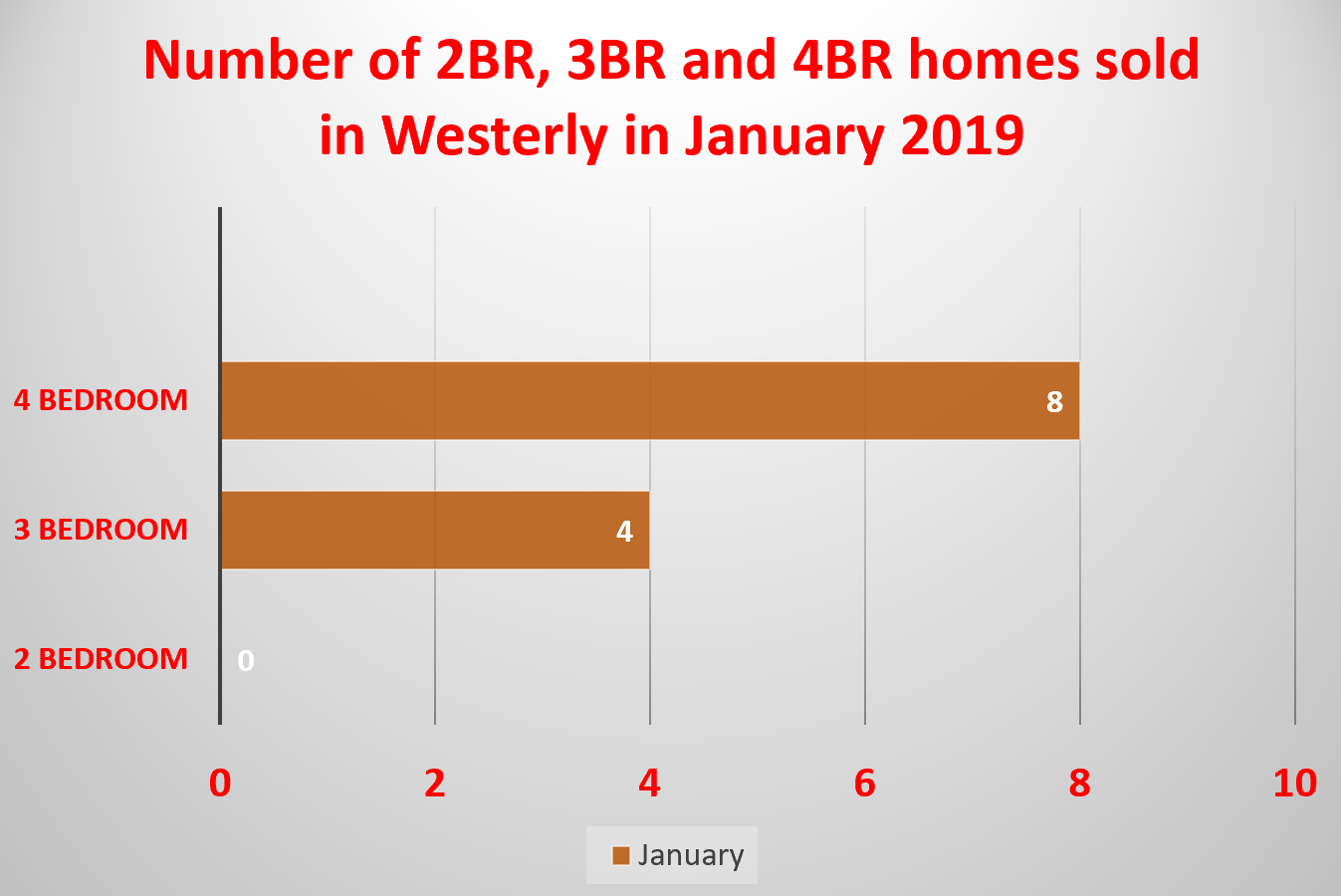

The Westerly Real Estate Market Report is a monthly statement of the average sales price for and number of 2 BR, 3 BR and 4 BR homes sold, the total number of sales, the number of active homes for sale , the number of homes for sale pending, and the average listing price of Westerly homes for sale.

| Real Estate Trends 2018 | Westerly | ||||||

| SOLD | UNITS | ||||||

| JANUARY | 2 BR | 3BR | 4BR | TOTAL | ACTIVE | PENDING | EXPIRED |

| Total Units | 2 | 11 | 3 | 16 | 83 | 21 | 4 |

| Average Price | 263750 | 404627 | 434833 | 392681 | 1439907 | 334438 | 429675 |

| Year To Date | 2 BR | 3BR | 4BR | TOTAL | ACTIVE | PENDING | EXPIRED |

| Total Units | 2 | 11 | 3 | 16 | 83 | 21 | 4 |

| Average Price | 263750 | 404627 | 434833 | 392681 | 1439907 | 334438 | 429675 |

According to Wikipedia, Westerly becomes a large tourist attraction during the summer months during which the population nearly doubles.

From east to west, well-known beaches include Weekapaug Beach, Westerly Town Beach, Misquamicut State Beach, East Beach and Watch Hill Beach.

Weekapaug is a Native American word meaning "end of pond". Niantics, Pequots, and Narrangansetts lived in this area before early settlers arrived.

Misquamicut Beach is a three-mile length of beach that extends westward from Weekapaug to Watch Hill and separates Winnapaug Pond from the Atlantic Ocean.

Watch Hill is an affluent coastal village in the town of Westerly, Rhode Island. It sits at the most-southwestern point in all of Rhode Island, excluding Block Island. Watch Hill came to prominence in the late 19th and early 20th century as an exclusive summer resort, with wealthy families building sprawling Victorian-style "cottages" along the peninsula.

Watch Hill is characterized by the New York Times as a community "with a strong sense of privacy and of discreetly used wealth", in contrast with "the overpowering castles of the very rich" in nearby Newport.

Today, Watch Hill is best known as the backdrop for the Ocean House, the only Forbes Five-Star and AAA Five Diamond Hotel in Rhode Island.

Wednesday, December 28, 2016

Westerly Real Estate

The Westerly Real Estate Market Report is a monthly statement of the median sales price for homes, the number of sales, the average price per square foot for homes, the number of homes for sale, and the average listing price of Westerly homes for sale.n

#WesterlyRealEstate

#OwnSweetOwn #WesterlyHomesForSale

Monday, November 28, 2016

Westerly Real Estate

The Westerly Real Estate Market Report is a monthly statement of the median sales price for homes, the number of sales, the average price per square foot for homes, the number of homes for sale, and the average listing price of Westerly homes for sale.n

#WesterlyRealEstate

#OwnSweetOwn WesterlyHomesForSale

Friday, October 28, 2016

Westerly Real Estate

The Westerly Real Estate Market Report is a monthly statement of the median sales price for homes, the number of sales, the average price per square foot for homes, the number of homes for sale, and the average listing price of Westerly homes for sale.n

#WesterlyRealEstate

#OwnSweetOwn #WesterlyHomesForSale

Subscribe to:

Posts (Atom)